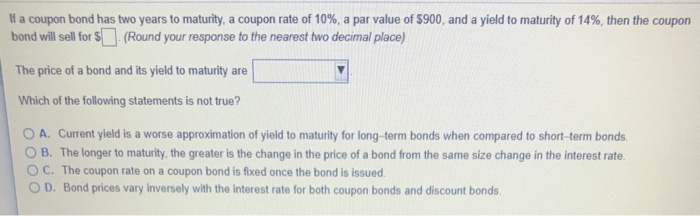

43 yield to maturity of coupon bond

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

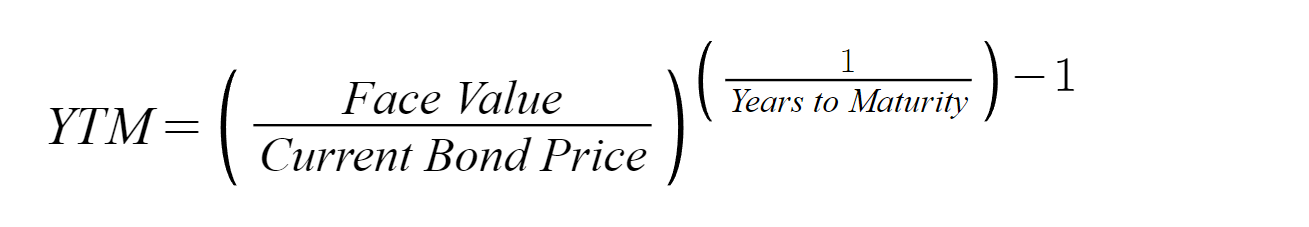

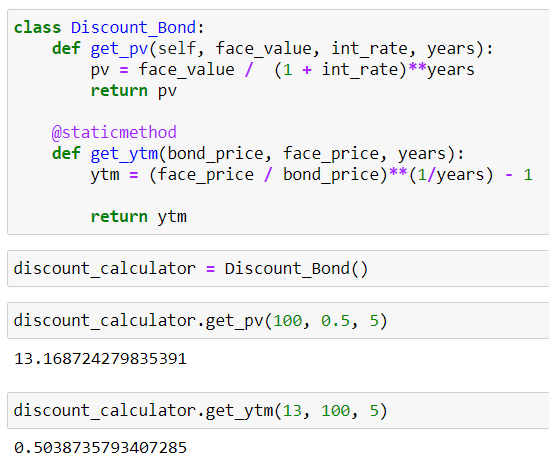

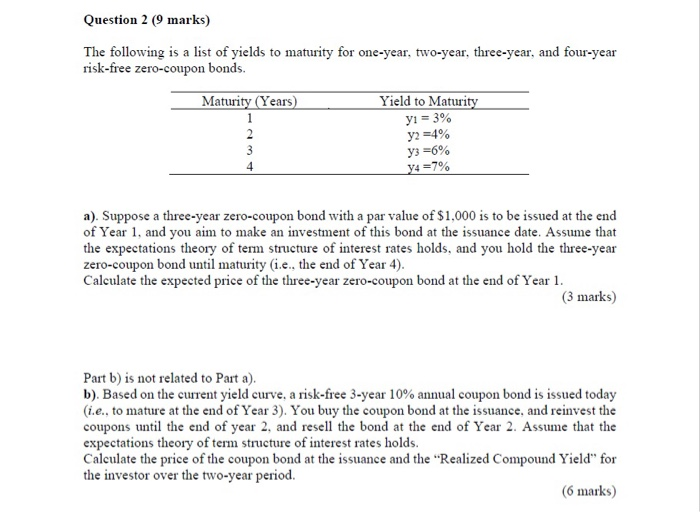

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Yield to maturity of coupon bond

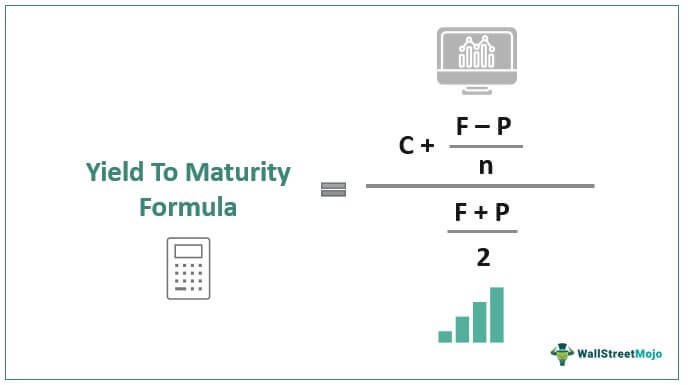

how to calculate bond yield to maturity in excel? There are a few steps involved in calculating bond yield to maturity in Excel: 1. Enter the bond's price into a cell. 2. Enter the face value of the bond into a cell. 3. Enter the coupon rate of the bond into a cell. 4. Yield to Maturity Calculator | Calculate YTM The yield to maturity calculator (YTM calculator) is a handy tool for finding the rate of return that an investor can expect on a bond. As this metric is one of the most significant factors that can impact the bond price, it is essential for an investor to fully understand the YTM definition. ... In our example, Bond A has a coupon rate of 5% ... Bond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest …

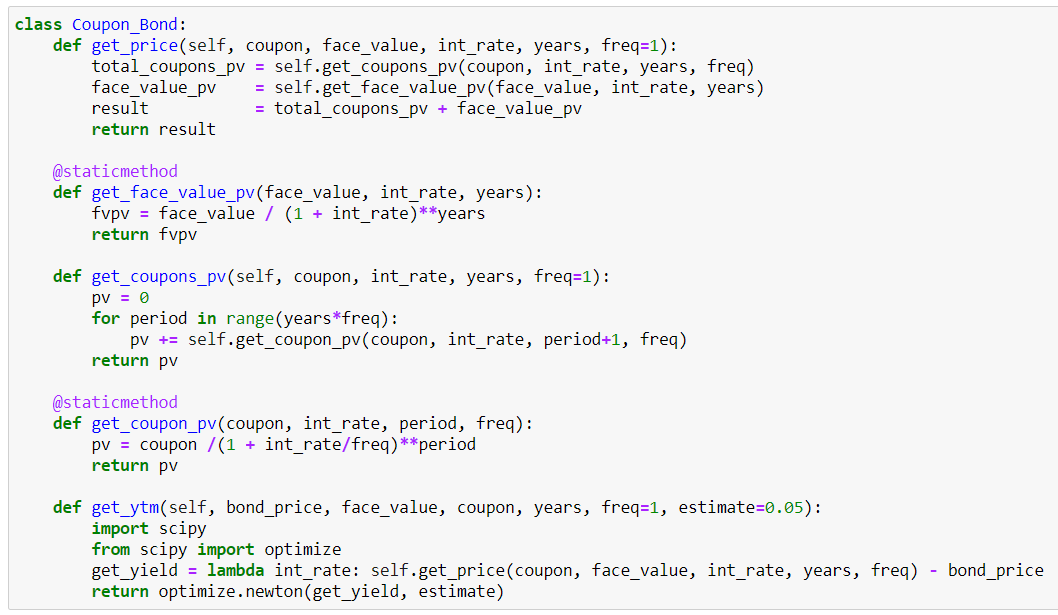

Yield to maturity of coupon bond. Yield to Maturity (YTM) - Definition, Formula, Calculation Examples The current yield of bond= Annual coupon payment/current market price read more, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of its bond term. In other words, a bond's expected returns after making all the payments on time throughout the life of a bond. Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Learn to Calculate Yield to Maturity in MS Excel - Investopedia Suppose the coupon rate on a $100 bond is 5%, meaning the bond pays $5 per year, and the required rate—given the risk of the bond—is 5%. Because these two figures are identical, the bond will ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

How to Calculate Yield to Maturity of a Zero-Coupon … Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ... Yield to Maturity (YTM) Calculator Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity. The ...

Solved The yield to maturity of a $1,000 bond with a | Chegg.com You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer. The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price? Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Current Yield vs. Yield to Maturity - Investopedia A bond's current yield is an investment's annual income, including both interest payments and dividends payments, which are then divided by the current price of the security. Yield to maturity ...

Bond Yield - Cbonds.com Yield to maturity (annually compounded yield to maturity, YTM (YTP/YTC)) is the annually compounded rate of return regardless of a bond's coupon period. This approach is used to calculate yields in Russian, Japanese, Norwegian, Italian, Danish, Swedish, and Spanish markets as well as a number of other countries.

Important Differences Between Coupon and Yield to Maturity Mar 04, 2021 · Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to …

Solved The yield to maturity of a $1,000 bond with a The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price? Part 1 The price …

When is a bond's coupon rate and yield to maturity the same? - Investopedia Vikki Velasquez. A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond ...

Yield to Maturity Calculator | Good Calculators The calculator uses the following formula to calculate the yield to maturity: P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y. Where: P is the price of a bond, C is the periodic …

Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can ...

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox The bond's yield to maturity is the interest rate at which the present value of all future cash flows is equal to the bond's current price. These cash flows consist of all coupon payments and the security's maturity value.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

When is a bond's coupon rate and yield to maturity the … Jan 13, 2022 · If an investor purchases a bond for its par value, the yield to maturity is equal to the coupon rate. If the investor purchases the bond at a discount, its yield to maturity is always...

Understanding Coupon Rate and Yield to Maturity of Bonds Jul 07, 2021 · The Yield to Maturity is a rate of return that assumes that the buyer of the bond will hold the security until its maturity date and incorporates the rise or fall of market …

Bond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest …

Yield to Maturity Calculator | Calculate YTM The yield to maturity calculator (YTM calculator) is a handy tool for finding the rate of return that an investor can expect on a bond. As this metric is one of the most significant factors that can impact the bond price, it is essential for an investor to fully understand the YTM definition. ... In our example, Bond A has a coupon rate of 5% ...

how to calculate bond yield to maturity in excel? There are a few steps involved in calculating bond yield to maturity in Excel: 1. Enter the bond's price into a cell. 2. Enter the face value of the bond into a cell. 3. Enter the coupon rate of the bond into a cell. 4.

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

Post a Comment for "43 yield to maturity of coupon bond"