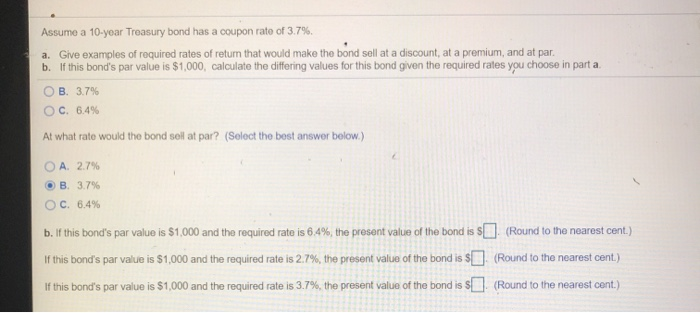

44 coupon rate 10 year treasury

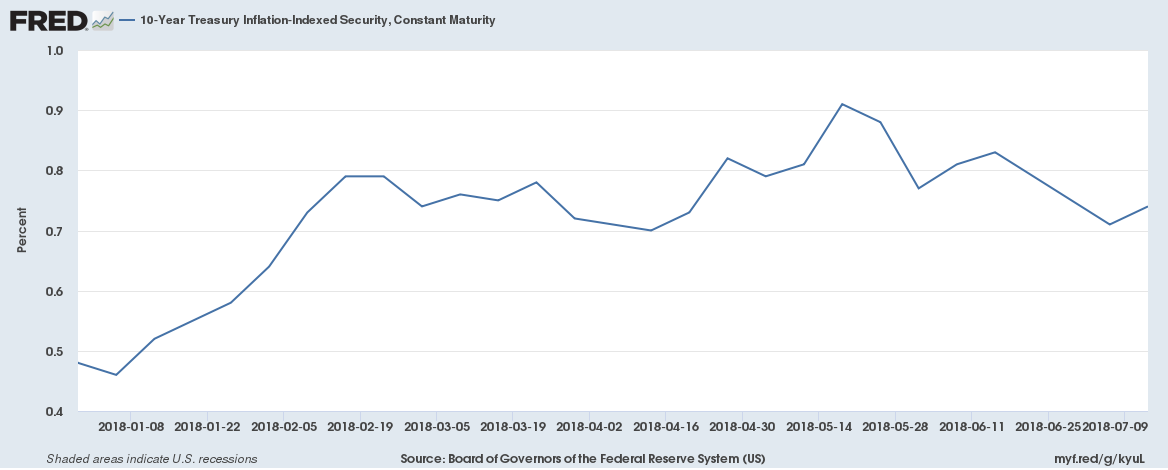

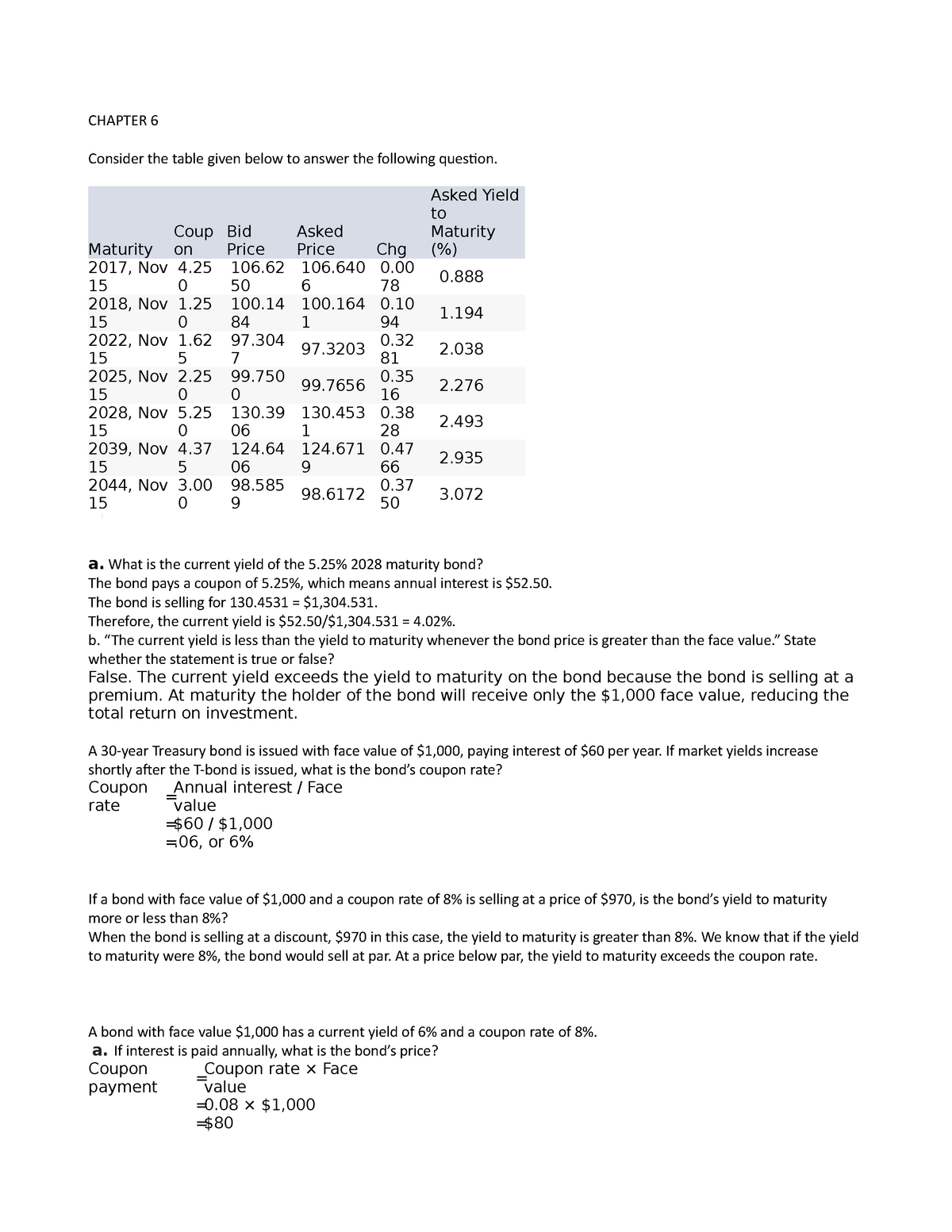

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Long-Term Rates and Extrapolation Factors. Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may ... 10-Year 0.125% Treasury Inflation-Indexed Bond, Due 01/15/2030 Graph and download economic data for 10-Year 0.125% Treasury Inflation-Indexed Bond, Due 01/15/2030 (DTP10J30) from 2020-02-20 to 2022-10-18 about TIPS, 10-year, bonds, Treasury, interest rate, interest, real, rate, and USA.

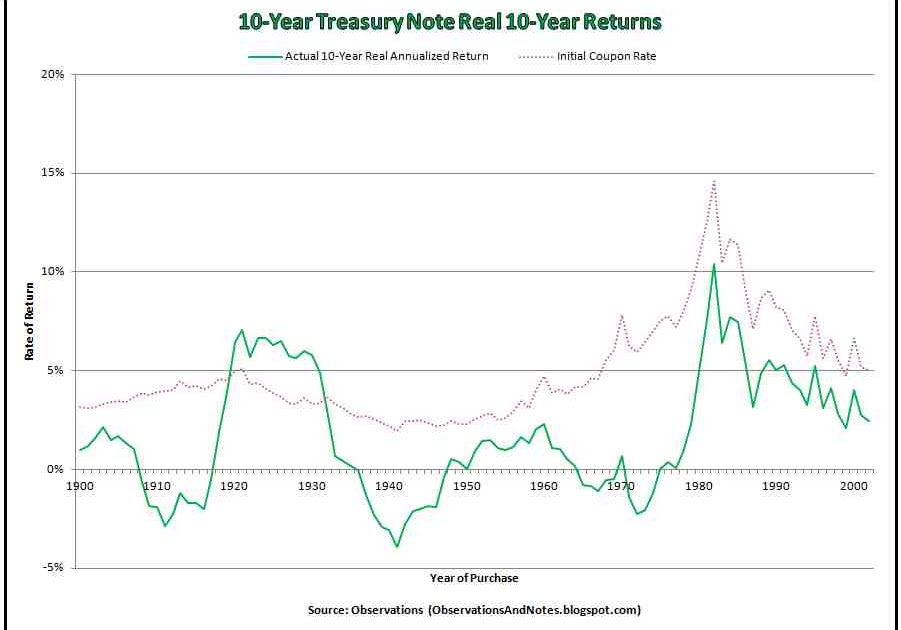

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds ...

/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Coupon rate 10 year treasury

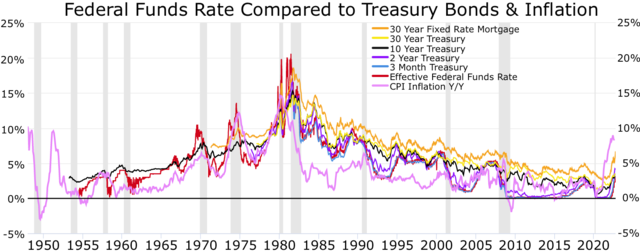

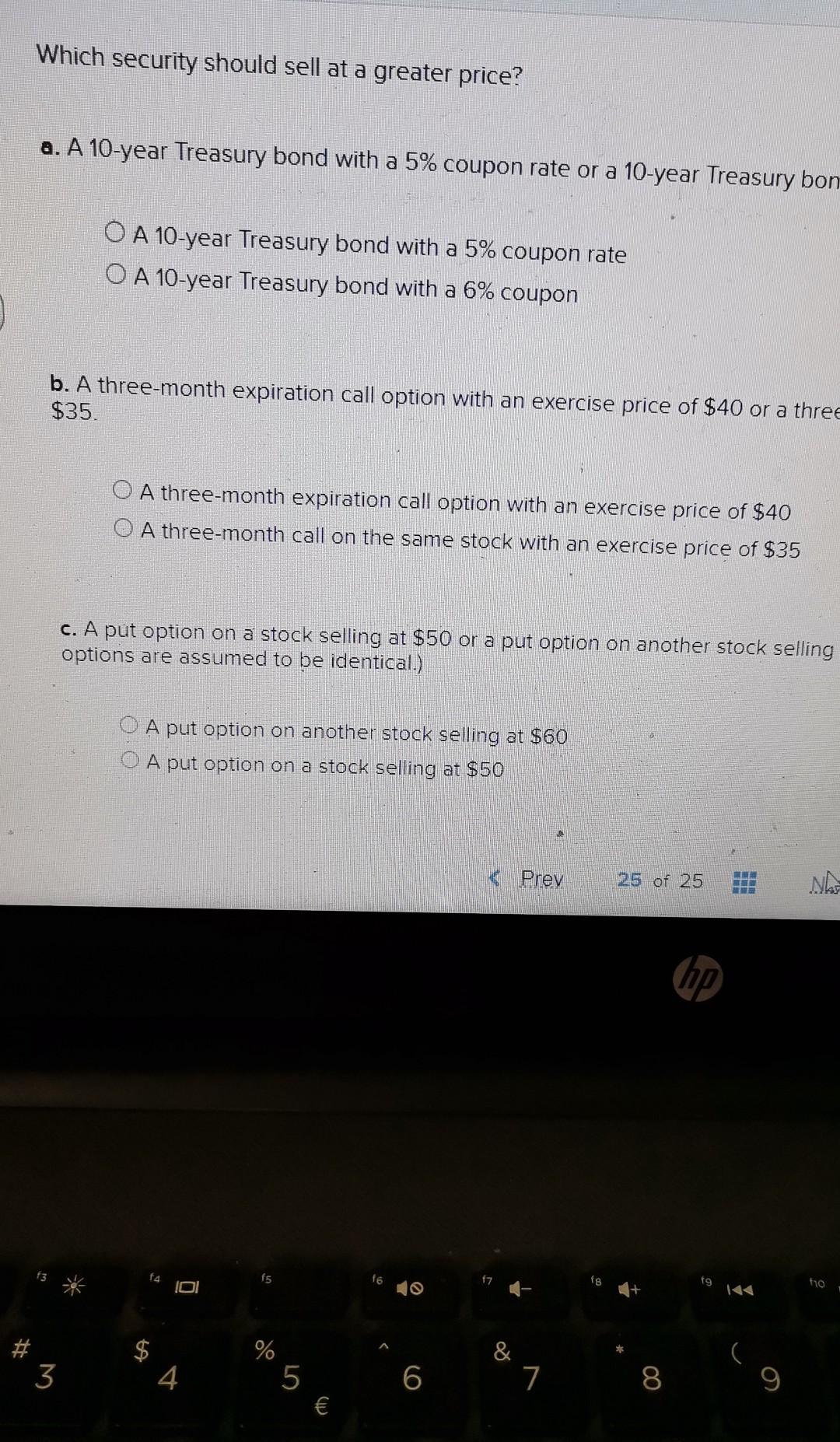

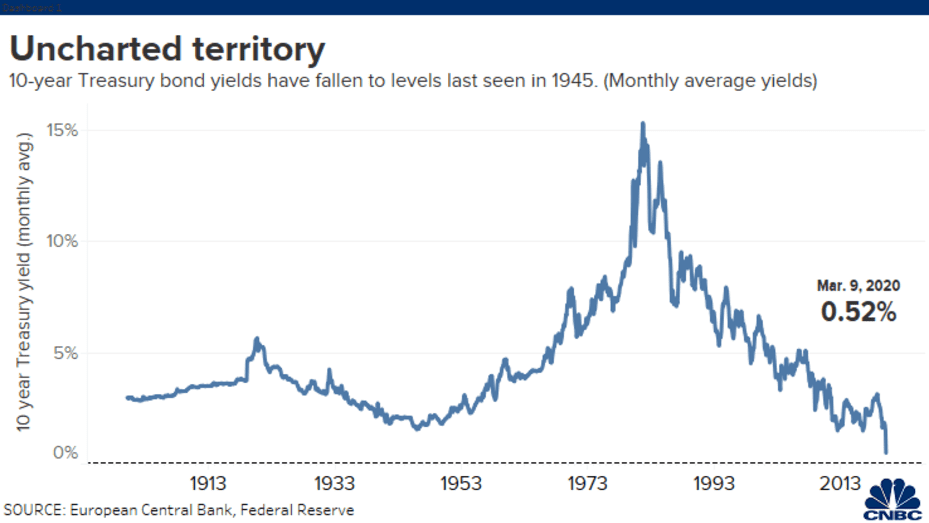

10 Year Treasury Rate - YCharts The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ... 10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US T-note is one of the most tracked treasury yields in the United States. Investors can assess the performance of the economy by looking at the Treasury yield curve. The yield curve is a graphic representation of all yields starting from the one-month T-bill to 30-year T-bond. The 10-year T-note is located in the middle of the ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Coupon rate 10 year treasury. 10-Year T-Note Futures Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ... 10-year Treasury yield has a path to 4.5% that could herald the stock ... The 10-year Treasury yield ( US10Y) is up 6 basis points to 4.29% in early trading. On Thursday it closed at its highest level since 2008, before the Financial Crisis sent yields tumbling. The 10 ... iShares 7-10 Year Treasury Bond ETF | IEF - BlackRock The iShares 7-10 Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years. Term Premium on a 10 Year Zero Coupon Bond (THREEFYTP10) Graph and download economic data for Term Premium on a 10 Year Zero Coupon Bond (THREEFYTP10) from 1990-01-02 to 2022-10-14 about term premium, 10-year, bonds, and USA. ... three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in order to evaluate the behavior of long-term yields, distant-horizon forward rates ...

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-09-30 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in ... United States 10 Years Bond - Historical Data - World Government Bonds Historical Data. Data Source: from 30 Apr 2007 to 16 Oct 2022. The United States 10 Years Government Bond reached a maximum yield of 5.297% (12 June 2007) and a minimum yield of 0.512% (4 August 2020). 10-year Treasury yield tops 4.2% for first time since 2008 The benchmark 10-year Treasury yield climbed 10 basis points 4.23%, at one point hitting 4.239% for its highest level since 2008. The yield on the policy-sensitive 2-year Treasury traded up five ... I bond interest rate will drop soon from a record high. Act fast. Act fast. Buy I bonds now to lock in a record 9.62% for 6 months. On Nov. 1, the rate drops to 6.48%. There haven't been many safe investments that could beat inflation except for the I bond ...

10 Year Treasury Rate - YCharts In depth view into 10 Year Treasury Rate including historical data from 1962, charts and stats. 10 Year Treasury Rate 4.02% for Oct 17 2022 Overview; Interactive Chart; Level Chart. Basic Info. 10 Year Treasury Rate is at 4.02%, compared to 4.00% the previous market day and 1.59% last year. This is lower than the long term average of 5.91%. Philippines 10 Years Bond - Historical Data - World Government Bonds Historical Data. Data Source: from 11 Sep 2016 to 17 Oct 2022. The Philippines 10 Years Government Bond reached a maximum yield of 8.189% (22 October 2018) and a minimum yield of 2.581% (17 August 2020). US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search the ... US 10 year Treasury. Yield 4.00; Today's Change-0.017 / -0.42%; 1 Year change +153.47%; Data delayed at least 20 minutes, as of Oct 18 2022 12:29 BST. ... Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US T-note is one of the most tracked treasury yields in the United States. Investors can assess the performance of the economy by looking at the Treasury yield curve. The yield curve is a graphic representation of all yields starting from the one-month T-bill to 30-year T-bond. The 10-year T-note is located in the middle of the ...

10 Year Treasury Rate - YCharts The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ...

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

Post a Comment for "44 coupon rate 10 year treasury"