40 coupon rate on bonds

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision These are bonds that have a coupon rate that increases over time. For example, a 5-year step-up bond of the par value of USD 100.00 may have a coupon rate of 5% for the first 3 years and 7% for the last two years. Thus the coupon payment looks as follows -

Coupon rate on bonds

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Bonds: These have maturities beyond 10 years & pay interest semi-annually. Longer duration bonds are more sensitive to shifts in interest rates. And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

Coupon rate on bonds. Coupon Rate Definition - Investopedia 28-05-2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... 14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Because zero-coupon bonds are widely issued, some form of interest must be included. These bonds are sold at a discount below face value with the difference serving as interest. If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt. Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. What is a Coupon Rate? - Definition | Meaning | Example The rate pays 8% annually. The coupon's current yield is 5.22%, and the yield to maturity is 3.85%. What is the coupon payment Georgia will receive? The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder. Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... What Is the Coupon Rate of a Bond? - The Balance 18-11-2021 · A bond’s coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the bond’s face value. The ... zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. What is 'Coupon Rate' - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market. How is the coupon rate of a bond calculated? - Quora Answer (1 of 3): The coupon rate is fixed when the bond is issued. It never changes. The term "coupon" is an old-fashioned term dating back to when borrowers —- Governments or Companies—- actually issued paper, bearer bonds. You'd lend the US Treasury $1000, and they would hand you an IOU with c... Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate: Formula and Bond Nominal Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more ” refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the principal amount when the bond …

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%.

Floating Rate Bonds: Characteristics, Rate, and Important Floating Rate Bonds offer certain benefits to both investors and issuers against the traditional fixed-rate bonds. Investors’ coupon payments adjust with changes in interest rates; As the floating rate is a combination of the Fed rate or LIBOR, it eliminates the volatility risk for investors;

Compare Fixed Rate Bonds | MoneySuperMarket Fixed term bonds generally have minimum and maximum opening deposits. Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable).

Coupon Rate | Investor.gov Glossary Coupon Rate The interest rate on a bond. It is expressed as a semi-annual rate.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

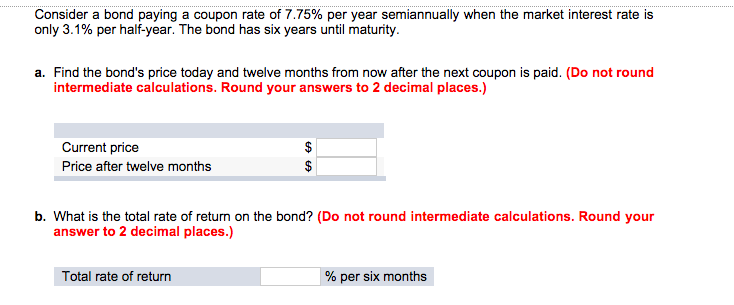

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

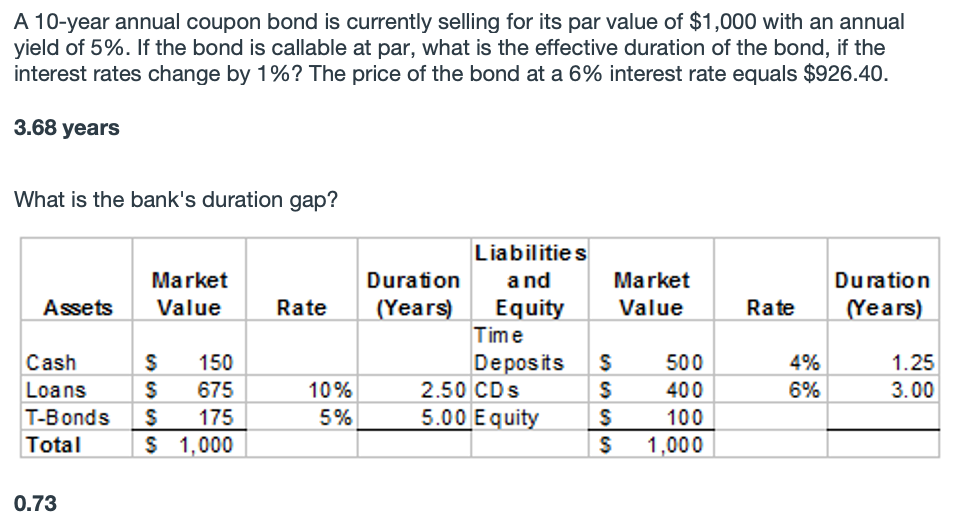

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Rate Structure of Bonds — Valuation Academy Some of the most common types of Bonds based on their coupon rate structures are: 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40 ...

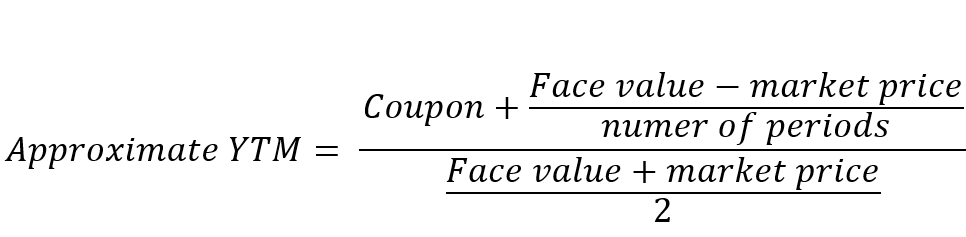

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Coupon Rate Of A Bond Security - Updated Information 2022 If you are looking for the latest and most special shopping information for "Coupon Rate Of A Bond Security" results, we will bring you the latest promotions, along with gift information, and information about Sale Occasions you may be interested in during the year. Promotions can be up to 79, with limited quantities. Therefore, we prioritize updating the latest information so that you do not ...

14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Because zero-coupon bonds are widely issued, some form of interest must be included. These bonds are sold at a discount below face value with the difference serving as interest. If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Post a Comment for "40 coupon rate on bonds"