42 zero coupon bonds advantages

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons. Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

Zero Coupon Bond - WallStreetMojo Advantages #1 - Predictability of Returns This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities etc.

Zero coupon bonds advantages

Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The... Solved: Zero-Coupon Bonds What are the advantages and ... Zero-Coupon Bonds . What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? Step-by-step solution. Chapter 7, Problem 7QAA is solved. View this answer View this answer View this answer done loading. View a sample solution. Step 1 of 2. Step 2 of 2. Back to top. The One-Minute Guide to Zero Coupon Bonds | FINRA.org This feature offers protection from the risk that you will have to settle for a lower rate of return if your bond is called, you receive cash, and you need to reinvest it (this is known as reinvestment risk). That said, zero-coupon bonds carry various types of risk.

Zero coupon bonds advantages. What is a Zero-Coupon Bond? Definition, Features ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc. Zero-Coupon Bonds - Tax Professionals Member Article By ... What are the advantages of zero-coupon bonds? Zero-coupon bonds are usually issued with a sudden reduction in their face value, which means that the investor can make large profits by holding them to maturity. The discount rate is intended to compensate for the time that investors have to wait before receiving interest payments. Zero-coupon ... What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. Advantages and Disadvantages of Bonds | Boundless Finance Convertible bonds: A convertible bond is a type of bond that the holder can convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price. Zero coupon bonds : A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face ...

Pros and Cons of Zero-Coupon Bonds - Kiplinger Instead, they're sold at a big discount to face value; when they mature, you collect the full amount. Their big advantage is that you know how much you'll collect a certain number of years from... Zero-Coupon Bond Definition - Investopedia Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1 A bond is a portal through which a corporate or governmental body... Zero-Coupon Bond - Definition, How It Works, Formula Extending the idea above into zero-coupon bonds - an investor who purchases the bond today must be compensated with a higher future value. Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds The Pros and Cons of Zero-Coupon Bonds One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... What Is a Zero Coupon Bond? - The Motley Fool In contrast, with a zero coupon bond with a face value of $100, paying 3%, you buy the bond for $74.41. You then wait 10 years, and at the end of those 10 years, the company pays you $100. Advantages Of Zero Coupon Bonds Advantages Of Zero Coupon Bonds - Advantages Of Zero Coupon Bonds, Lynda.com Premium Subscription Coupon, Cannabis Deals Near Me, Fingerhut Free Shipping Coupon 2019, Food Freebies 2019, Printable 40 Coupon Hobby Lobby, Gateway Film Center Osu Coupons Zero Coupon Bonds What are the advantages and ... Low- and zero-coupon corporate bonds are purchased mainly for tax-exempt investment accounts (such as pension funds and individual retirement accounts).Chapter 7: Bond MarketsWEBTo the issuing firm, these bonds have the advantage of requiring low or no cash outflowduring their life.

A zero-coupon bond is a discounted investment that can ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them more attractive to investors. As a result, these bonds often come with higher yields than traditional bonds.

Zero-Coupon Bonds: Definition, Formula, Example ... Advantage of Zero-Coupon Bonds From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages Zero-coupon bonds are long-term debt instruments. These are ideal for investors who are planning their retirement. The longer the time until maturity, the lower the price of a zero-coupon bond. These bonds are traded on the stock exchange, and investors can choose to sell them before maturity. Prices fluctuations of Zero-Coupon Bond

Advantages and Disadvantages of Bonds | Boundless Finance ... Convertible bonds: A convertible bond is a type of bond that the holder can convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price. Zero coupon bonds : A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face ...

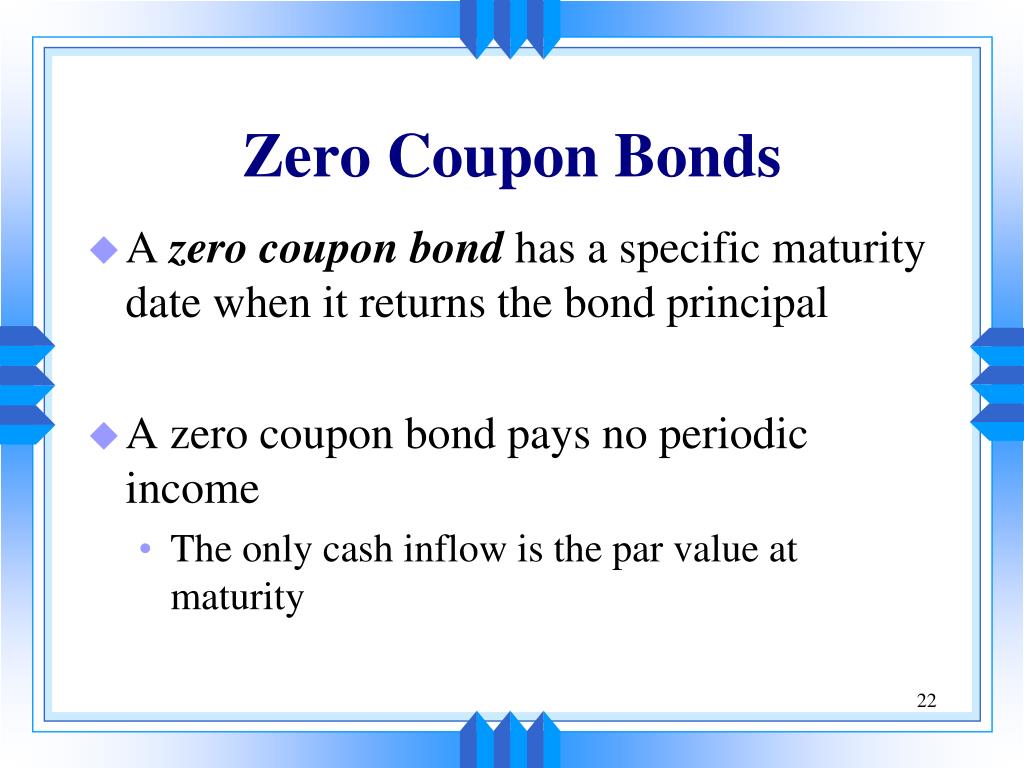

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Zero Coupon Bonds What are the advantages and ... ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest expense for federal income tax purposes, which adds to the firm's cash flow.

Zero-Coupon Bonds: Pros and Cons Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

Understanding Zero Coupon Bonds - Part One Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value Some issuers may call zeros before maturity You must pay tax on interest annually even though you don't receive it until maturity Zero coupon bonds are more volatile than regular bonds

What are Zero Coupon Bonds? Explain some of its variants. Features, Advantages, and Disadvantages Zero-Coupon. The basic difference between other normal bonds with coupon rates and zero-coupon bonds is the coupon rate only. ZCBs carry no interest rate, whereas other bonds carry some interest rate and enjoy regular income from them.

Zero Coupon Bonds India- Invest in Zero Coupon Bonds Advantages of Zero Coupon Bonds Investors often compare zero coupon bonds with other fixed income options so as to check in for minimal risks. The returns on zero coupon bonds are good enough at maturity and the option always remain to sell them in the secondary market, if the interest rates decline intensely.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds. They often have higher interest rates than other bonds. Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org This feature offers protection from the risk that you will have to settle for a lower rate of return if your bond is called, you receive cash, and you need to reinvest it (this is known as reinvestment risk). That said, zero-coupon bonds carry various types of risk.

Solved: Zero-Coupon Bonds What are the advantages and ... Zero-Coupon Bonds . What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? Step-by-step solution. Chapter 7, Problem 7QAA is solved. View this answer View this answer View this answer done loading. View a sample solution. Step 1 of 2. Step 2 of 2. Back to top.

Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The...

Post a Comment for "42 zero coupon bonds advantages"